Ulupono urges streamlined approach to keep state energy goals on track

Dec 18, 2024

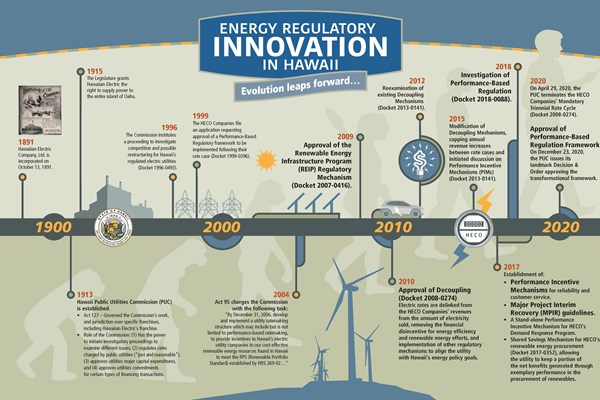

Hawai‘i stands at a critical juncture in its renewable energy transformation. The state’s innovative regulatory approach, Performance-Based Regulation (PBR) — approved in 2020 by the Hawai'i Public Utilities Commission (PUC) — has positioned Hawai‘i as a national leader in reimagining electric utility incentives to accelerate clean energy adoption.

However, recent challenges such as the COVID-19 pandemic and Maui wildfires underscore the need for an agile, efficient approach.

In a December 5, 2024 brief, Ulupono recommended a nuanced strategy for the transition from the first Multi-year Rate Plan (MRP1) to the second (MRP2). The main focus of the proposal is the recommendation that the PUC deploy a limited “true-up” for the first year of MRP2, which would adjust Hawaiian Electric’s revenue to more closely align with its allowed Return on Equity (ROE) of 9.5% as a starting point for the new MRP. Essentially, ROE is a financial performance metric that measures a company's profitability by revealing how effectively a company is using shareholders' invested capital to generate profits.

The Ulupono team highlights that Hawaiian Electric's current ROE would have been 9.2% in 2023 with two simple adjustments: removing a $5 million Consumer Dividend payment and adjusting the capital structure equity percentage. This minimal intervention would eliminate the need for a full rate case, which Ulupono argues would undermine the statutory intent of PBR and be costly and time consuming.

As mandated by Act 5 (SLH 2018) and codified in HRS §269-16.1: “… the public utilities commission shall establish performance incentives and penalty mechanisms that directly tie an electric [utility’s] revenues to that utility's achievement on performance metrics and break the direct link between allowed revenues and investment levels.”

Ulupono also suggests adopting a “notional revenue adjustment” methodology similar to one used in Alberta, Canada. This approach would base revenue adjustments on historical trends in capital and operations costs, avoiding the potential pitfalls of forward-looking cost projections. Further, the brief emphasizes the importance of maintaining strong Performance Incentive Mechanisms (PIMs), recommending they be increased to up to 2% of ROE to meaningfully incentivize utility performance. Ulupono argues that without robust PIMs, utility revenues would primarily reward spending rather than actual performance.

The PUC continues to review these recommendations as part of its ongoing evaluation of utility regulation as the state remains committed to its goal of achieving 100% renewable electricity by 2045. A stable, financially healthy, and high performing electric utility will be crucial to enable the state’s transition to renewable energy by reducing dependence on expensive, imported fossil fuels. Furthermore, this transition would enable a more stable, resilient energy system that can better withstand climate-related disruptions and economic uncertainties.

Link to Ulupono’s December 5, 2024 brief here.

For more information, link to Docket No. 2018-0088